Why Payment Orchestration is Revolutionizing the Industry

In a rapidly evolving digital economy, businesses face increasing pressure to offer seamless and secure payment experiences across a growing number of markets and channels. For years, traditional payment gateways have been the go-to solution for processing online payments. However, as customer expectations rise and businesses expand globally, many are discovering that traditional gateways fall short. Enter Payment Orchestration—the next frontier in payment innovation.

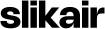

What is Payment Orchestration?

Payment orchestration is a comprehensive solution that acts as a centralized hub for managing payment processes. Unlike traditional gateways that typically route transactions through a single provider, an orchestration platform connects businesses to multiple payment processors, gateways, and alternative payment methods.

This approach provides unparalleled flexibility, efficiency, and control over the entire payment ecosystem, empowering businesses to optimize every transaction.

1. Enhanced Approval Rates

Traditional gateways often rely on a single payment provider, which can lead to declined transactions due to network issues, fraud flags, or geographic limitations. Payment orchestration platforms intelligently route transactions through the best-performing providers, improving approval rates and reducing payment failures.

2. Cost Optimization

By offering access to multiple providers, orchestration platforms enable businesses to choose payment processors based on transaction cost, geography, or currency. This dynamic routing capability reduces operational expenses while maximizing profitability.

3. Scalability Across Markets

Expanding into new markets often requires integrating local payment methods and complying with regional regulations. Payment orchestration platforms simplify this process, supporting multiple currencies, languages, and payment methods without the need for separate integrations.

4. Advanced Fraud Prevention

With rising cyber threats, security is paramount. Orchestration platforms leverage sophisticated fraud prevention tools, such as real-time risk assessments and AI-driven fraud detection. These measures protect businesses and customers alike, minimizing chargebacks and fraud losses.

5. Unified Reporting and Analytics

One of the biggest challenges with traditional gateways is fragmented data. Payment orchestration consolidates transaction data into a single dashboard, providing actionable insights into performance, customer behavior, and revenue trends.

Key Industries Benefiting from Payment Orchestration

Payment orchestration isn’t just for e-commerce businesses. Its benefits extend to a wide range of industries, including:

- iGaming: Optimizing high-volume transactions and managing compliance.

- Travel: Supporting multi-currency payments for global customers.

- Forex: Ensuring secure, real-time processing.

- E-Commerce: Streamlining checkout and improving conversions.

Moving Beyond Traditional Gateways

Traditional gateways paved the way for online payments, but they often lack the flexibility, scalability, and innovation required in today’s competitive landscape. Payment orchestration solves these challenges by offering a unified, intelligent, and adaptable solution that grows with your business.

Whether you’re a small business or a global enterprise, payment orchestration empowers you to deliver exceptional payment experiences, reduce costs, and scale effortlessly.

Ready to Embrace the Future of Payments?

At slikair, we specialize in payment orchestration solutions designed to help businesses thrive in a global market. From intelligent routing to advanced fraud prevention, our platform delivers everything you need to stay ahead in the digital economy.

🚀 Contact us today to learn more about how slikair can transform your payment operations.